Как работают апселл и кросс-селл в интернет-магазине?

Содержание:

- What is cross-selling?

- Remind Past Buyers Why They Chose You

- Cross-Selling vs. Upselling

- How mobile banking helps to cross-sell

- Рекомендации по повышению эффективности кросс-продаж

- Upsell Or Cross-sell? Are They the Same?

- When is the best time to cross-sell?

- Cross-sell grid for identification of opportunities

- Use Predictive Analytics to Provide New Product Recommendations

- Abandoned Shopping Carts? Don’t Let Past Buyers Forget

- Факторы успеха

- What is Cross Selling?

- Build an Omnichannel Customer View

- Three Examples of Cross Selling and Upselling

- Bank Case Study: Next Best Product Recommendation Model

- Special Considerations

- Что такое кросс-продажи

- How Cross-Selling Works

- Что такое up-sale, cross-sale и down-sale продажи

- Cross-selling challenges

What is cross-selling?

Cross-selling is based on offering the customer goods that are complementary to other things they have purchased or about to purchase.

Cross-selling is a risk-free chance to boost sales. The worst that can happen is that the suggested product is ignored. The goal of this strategy is to remind the buyer about products that may prove useful and even needed in the near future.

Cross-selling helps to save the customer’s time by making everything available at once. To fully understand this situation, let’s looks at one of the most common examples.

Let’s say you are in a popular chain in the footwear industry. After a long struggle with your own thoughts about buying the right shoes, you go to the cash register to pay for them. At this point, the saleswoman asks:

— Could I recommend our best natural leather protector? Using it will allow you to preserve the appearance of your shoes regardless of weather conditions …

You think about it. You know that this product may be useful to you, but you’re still not sure. Eventually, you give in and add it to your purchase.

This was cross-selling. While purchasing a basic product, you have decided on a complementary product.

Remind Past Buyers Why They Chose You

What is about your company, products, or services that makes you stand out? Why do customers choose you over your competition? Remembering these points in your messaging to past consumers will instill a new sense of brand loyalty into them. And if you’re able to get a true brand-loyal consumer then your chances of retaining them for a longer period of time, and even getting referrals from them, will increase tremendously.

This is why branding campaigns shouldn’t only be used for top-of-the-funnel audiences who have never heard of your company before. Rather, sell the emotion-evoking components of your brand to past-purchasers to make them lifetime customers.

Cross-Selling vs. Upselling

Cross-selling and upselling are sales tactics used to convince customers to purchase more. However, there are differences to consider.

Upselling, also known as suggestive selling, is the practice of persuading customers to purchase an upgraded or more expensive version of a product or service. The goal is to maximize profits and create a better experience for the customer. That experience can translate into an increase in the customer’s perceived value and an increased Customer Lifetime Value (CLV)—the total contribution a customer makes to a company.

Companies are 60-70% more likely to sell to an existing customer, whereas the likelihood of selling to a new customer is 5-20%.

For companies, it is easier to upsell to their existing customer base than it is to upsell to a new customer. Existing customers trust the brand and find value in the products and/or services. This trust drives the success of upselling. For instance, if a customer trusts a brand, they will generally trust the brand when it presents a seemingly better option.

Alternatively, cross-selling is the sales tactic whereby customers are enticed to buy items related or complementary to what they plan to purchase. Cross-selling techniques include recommending, offering discounts on, and bundling related products. Like upselling, the company seeks to earn more money per customer and increase perceived value by addressing and satisfying consumer needs.

How mobile banking helps to cross-sell

By contrast, mobile banking allows showing the message any time the customer enters the app. The SMS channel shows better cross-selling results as it allows sending actionable information, but still it lacks the level of personalization achieved by using a mobile banking app. Yet, to leverage the mobile banking channel, a bank needs to go far beyond a standard delivery of promo messages.

The first step towards effective cross-selling starts with defining the actual needs of each customer. This can be achieved by analyzing customer buying behavior for financial products. This approach complements classic cross-selling practices that segment customers according to demographics, age and income. To be precise, banks can use customers’ current actions or recent transactions as triggers for creating an effective cross-selling message. Taking into account customers’ real-time behavior in a mobile app, a bank can bind a relevant marketing message exactly to the moment when a customer needs a product.

For example, a bank can put a promotional message in a personal financial management (PFM) tool, which usually includes the possibility to add customers’ personal goals (e.g. buying a house). Banks can analyze this data and benefit from it by promoting relevant products, such as a mortgage, in PFM. A bank can also suggest customers with volatile high balances on their debit cards to buy a deposit certificate by showing an advertisement with interest rates they’ll be receiving per month. Thus, a bank will get a chance to freeze a fixed amount of money on deposits. In case a bank has a network of partner merchants, it can use geo-fencing to show relevant offers or installments that can be bought locally using a credit card.

However, this process takes regular refining of promotional messages to cross-sell the most relevant product for this particular customer, with a certain sum, interest rate and duration. Potentially, banks can cross-sell almost any product or service, be it on the liability side (i.e. deposit, savings or checking accounts, etc.) or on the asset side (i.e. auto loans, student loans, mortgages, etc.), which makes cross-selling a versatile tool to increase a bank’s profits.

Рекомендации по повышению эффективности кросс-продаж

Теперь мы знаем, как писать письмо о допродаже и выбрать подходящие продукты

На что же обратить внимание при составлении коммерческого предложения, чтобы оно действительно сработало? Вот несколько советов:. Изучите действия посетителей на сайте

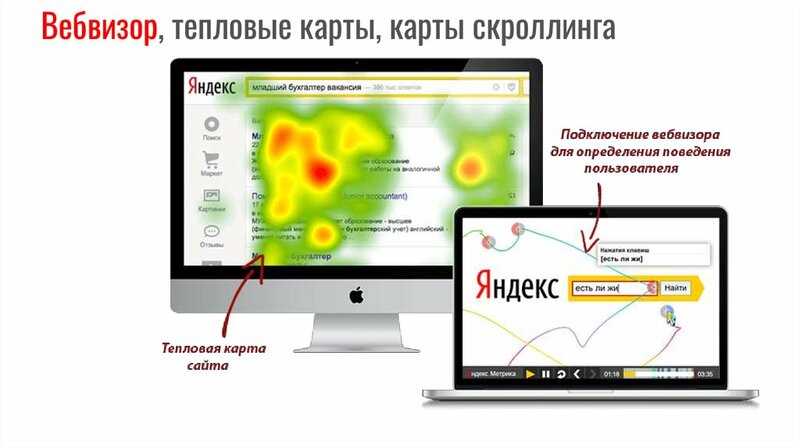

Изучите действия посетителей на сайте.

Просмотрите путь их навигации по разделам, где люди побывали в первую очередь. Так вы поймете, что предложить клиенту в дополнение к покупке и как улучшить географию ресурса.

Для контроля поведения можно выбрать любой аналитический веб-сервис. Из популярных – бесплатный Google Analytics или «Яндекс.Метрика». Необходимо интегрировать счетчик (фрагмент кода) в HTML-разметку сайта, чтобы сервис отслеживал, откуда переходит посетитель (страна, город, браузер), сколько времени находится на страницах, что просматривает чаще всего, куда перемещается и т. п. Например, используя «Вебвизор» в «Яндексе», вы увидите, как ведет себя пользователь в реале (работает мышкой, нажимает на кнопки и др.).

Необходимо понимать, какую болевую точку закрывает ваш продукт или услуга. Тогда намного проще подобрать сопутствующие товары, которые усилят пользу от покупки. Исследуйте нуждаемость своей целевой аудитории, используя эту статью. Составьте список основных характеристик и сделайте портрет для каждого сегмента.

Побуждайте человека к быстрому решению.

Организуйте для него сопутствующую покупку в один клик, не уходя от основной задачи. Для этого рекомендуемые товары должны быть в поле зрения заказчика, чтобы долго не прокручивать страницу. Подробное описание поместите во всплывающие окна, которые появятся при наведении курсора мыши на товар. Тут же установите интерактивную кнопку «Купить».

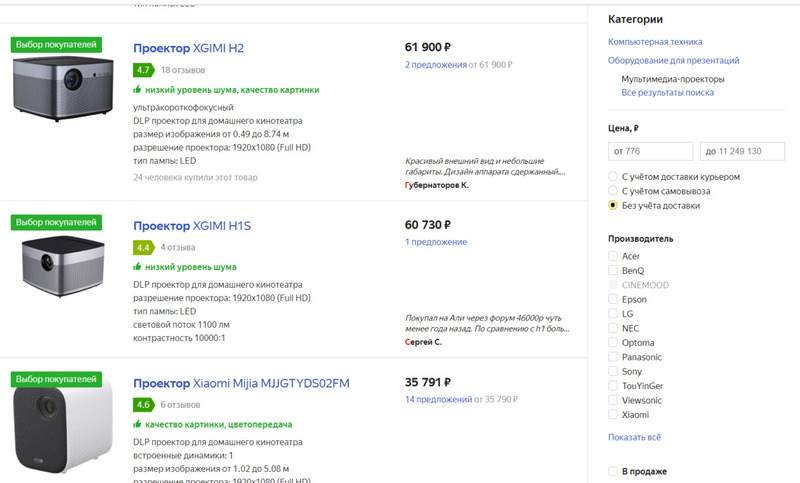

Пользуйтесь авторитетностью чужого мнения.

Продемонстрируйте, что с выбранным продуктом приобрели другие покупатели. Или покажите, что в данном случае советует купить производитель (расходные материалы, сопутствующие предметы). Среди других товаров этой группы их лучше выделить каким-нибудь значком. Так, к телефонам марки Xiaomi дополнительно предложены наушники различных фирм. Однако на родных наушниках самой компании «Сяоми» стоит знак «Лучший выбор производителя».

Показывайте сочетание товаров.

Если при оформлении заказа вы хотите предложить клиенту кросс-продажи в страховании или других сферах бизнеса, объясните выгоду от этих двух продуктов вместе взятых. То же самое в обычных магазинах. При покупке джинсов покажите их вместе с рекомендуемым свитшотом, пусть человек увидит, как выглядит комплект. На электронных коммерческих площадках можно наложить сопутствующие товары прямо на картинку основного или разместить их тут же на странице. Если доски и очки для сноуборда распределить по разным категориям, шанс их продать в наборе резко упадет.

Сергей Азимов убойные фишки в продажах!

Выбирайте удачное место.

Если в ассортименте магазина есть универсальные товары, релевантные ко всем покупкам, разложите их поближе к кассе и местам с высоким трафиком клиентов. Простую вещь, которая не нуждается в объяснении функционала, многие без колебаний положат в корзину, не дожидаясь совета продавца. Это повышает шансы импульсивных кросс-продаж.

Подключайте стимул.

Привлекайте внимание к сопутствующим товарам посредством мотиваторов. Это может быть бесплатная доставка, подарочная упаковка на дополнительную вещь и др

Только проверьте, чтобы стимул не обошелся вам дороже прибыли от самого кросс-сейла.

Предварительное упоминание.

Независимо от времени, необходимого клиенту для решения о сделке, старайтесь как можно раньше показать ему товары, которые вы хотите допродать. Если вы задержите кросс-предложение, человек может определиться с бюджетом своей покупки и сочтет ваши советы неуместными. Совсем необязательно в начале разговора описывать сопутствующие товары. Это будет подготовительным этапом к вашему коммерческому предложению, озвученному чуть позднее, когда клиент будет к нему готов и правильно воспримет ваши действия.

Upsell Or Cross-sell? Are They the Same?

Upsell and cross-sell are often confused and used interchangeably, but there is a meaningful difference between the two.

Upsell is when you encourage your customer to buy a higher priced alternative of the current consideration. Upselling encourages customers to purchase a more expensive model in the same product or service family, or to augment the original purchase with additional features such as warranties.

A familiar example is when retailers offer consumers to add a protection plan to their purchase, as shown below.

example in retail banking

Cross-selling and upselling are closely related because they both focus on providing additional value to customers, rather than limiting them to products they have already considered or purchased. The key to success in both is to understand what your customers value most and then respond with products and services that truly meet those needs at the right time and through the optimal channel.

When is the best time to cross-sell?

Knowing when to cross-sell is just as important, if not more so, than the initial sale itself. If you try to sell to a client at the wrong time, it can damage your relationship moving forward or negate the original sale entirely.

No single approach or rule dictates the best time to cross-sell.

However, by remembering the central goal of cross-selling — to persuade a customer to purchase a service that complements their original purchase — you can time the sale just right. Simply put, the best time to cross-sell is when the sale makes sense.

Example

If you were a video game store, a great opportunity to cross-sell video games would be when somebody purchases a new console.

As an agency, if you have a client who has just launched their social media accounts, you may offer social media management to help attract new followers. If a client just launched Google and Facebook Ads, you might offer post-click landing page design services to generate more traffic and leads.

Ultimately, there is no exact time to cross-sell, but there are plenty of wrong times, and it’s up to you to determine when to make the call. Some sales may go well immediately after a client signs with you, whereas others are best saved for later in the relationship.

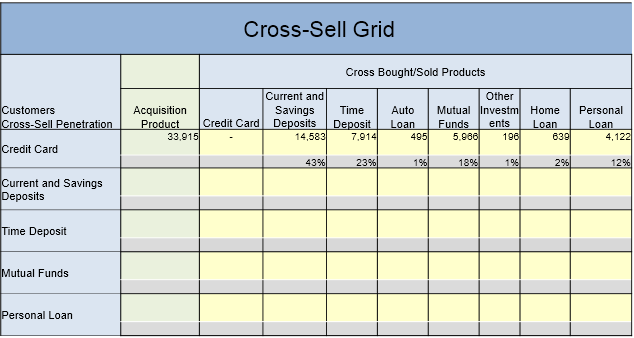

Cross-sell grid for identification of opportunities

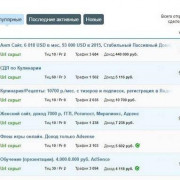

A cross-sell grid is a mapping of products held by customers and which is segmented by product group. The grid is created based on a unique customer identification key. The product on the vertical axis usually refers to the first relationship of the customer with the bank.

Here is an example below. In this grid, a good percentage (43 % = 14,583/33,915)) of credit card customers hold current and savings deposit products. We can conclude that this specific cross-sell program is a successful one. However, a bigger push for unsecured and secured loans is required as the penetration of these loans among credit card customers is relatively low. Clearly this segment is an untapped opportunity.

Use Predictive Analytics to Provide New Product Recommendations

Customer journey data can be used to predict each customer’s likelihood of responding to a cross-sell or upsell offer. Input data can include the products and/or services that are commonly purchased and used in conjunction with one another. This data can be further analyzed to identify which customers bought, as well as the dates when the purchases were made.

This knowledge is valuable for the product marketing team to create product and pricing bundles. These product recommendations are also valuable to provide to customer support teams, so they can make real-time cross-sell or upsell suggestions based on each customer’s specific situation.

Hyatt Hotels Uses Predictive Analytics to Boost Revenue

Hyatt Hotels has aligned its operations across 500 hotels globally to use predictive analytics for cross-selling and upselling.

Hyatt used guest history and preferences from their membership program to identify guests with similar profiles and create customized offers for each based on a unique combination of amenities, room upgrade, or activity packages. The program worked by prompting front desk agents with relevant and timely messages such as, “Based on what we know, this person will want a room with an ocean view” or “This person will likely be looking for a spa package.”

Using predictive analytics for cross-selling and upselling, Hyatt was able to increase the average incremental room revenue post reservation by 60%, compared to similar programs in the past that did not use sophisticated analytics.

The hotel industry, in general, is rich with raw data, which when stitched together throughout the customer journey, allows marketers to move past basic audience attributes and discover more specific and relevant attributes for better engagement and personalized service offerings.

The most common barrier to getting and implementing real-time insights is that the data lives in silos in disparate systems such as property management system (PMS), point-of-sale (POS), central reservation system (CRS), call center, spa, food and beverage department etc. In most cases, this data does not get consolidated with the rest of the hotel’s online data from web analytics, guest satisfaction surveys and social media.

Customer journey analytics platforms can solve this problem by integrating data from different sources into one central platform that sits as an intelligence layer with existing technology stack. In this way, customer journey analytics generates insights for marketers and customer experience teams.

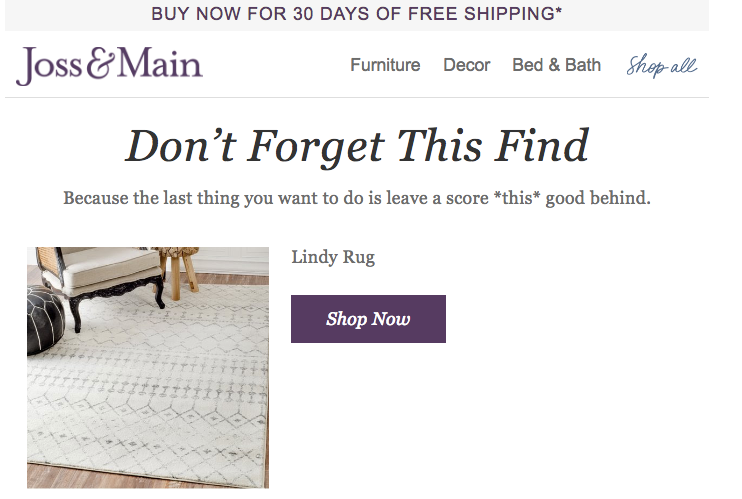

Abandoned Shopping Carts? Don’t Let Past Buyers Forget

If you have repeat customers who are abandoning their shopping carts, it’s not always the case that they lost interest in those items. Rather, they may have been distracted in our society that’s built to distract (“It’s not you, it’s me”). In this situation, don’t be afraid to remind past buyers about what they almost purchased.

You can also use remarketing to target cart abandoners! Use display ads to remind past buyers what they’re missing out on, or try Gmail ads.

This does not go just for e-commerce businesses. If you are in the SaaS industry, for instance, take note of when current customers spend a significant amount of time on a related product page. That time could be anywhere from one to thirty minutes. The time frame is something you will need to determine from past conversion statistics, but allow this as a chance to connect with current customers at the right time to upsell them on these products. Timing is everything when it comes to upselling! This leads me to the next tip…

Факторы успеха

Кросс-продажи полностью основываются на психологии покупателя, на его спонтанном желании совершить покупку, которую он не планировал. Из этого следует необходимость учитывать нюансы поведения покупателя, чтобы благоприятный момент не был упущен.

Основой здесь будет изучение покупательского спроса. Могут применяться самые разнообразные методы, от опроса аудитории до экспериментов, когда предлагаются клиентам поочередно различные дополнительные к основному товары, с анализом результатов.

В некоторых случаях кросс-продажи осуществляют через формирование наборов товаров. Например, для покупателей, у которых время на покупки ограничено, основные продукты могут предлагаться пакетом, который приобретается за один раз и используется в течение недели

Говоря о кросс-продажах посредством акции, необходимо обращать внимание на ее сроки, ограниченность, иначе эффект будет сведен к нулю

Работа с персоналом тоже является фактором успеха. Продавцов обязательно необходимо обучать технике кросс-продаж, предлагать грамотно составленные методические материалы, схемы диалогов с покупателем.

Таблица (матрица) совместимости товаров поможет продавцу быстро сориентироваться и сделать клиенту нужное предложение. Обычно она представляет собой сетку, в которую по вертикали и по горизонтали внесены товары (например, по строкам основные товары, а по столбцам дополнительные; галочками отмечаются нужные пересечения).

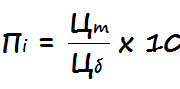

Важный элемент успеха – контроль эффективности кросс-продаж.

What is Cross Selling?

Cross selling is the process of encouraging customers to purchase products or services in addition to the original items they intended to purchase. Oftentimes the cross-sold items are complementary to one another so customers have more of a reason to purchase both of them.

After a customer has added an item to their cart or initiated the checkout process, they are implicitly telling the business they are an active customer and have the intent to purchase. At this point of the buyers’ cycle, businesses will often implement a cross sell by recommending a complementary item or by providing a discount if both are purchased together.

As most customers are ready to make a purchase at this step anyway, they have already gotten over a major hurdle and are more likely to make a last-minute impulse purchase given the appropriate offer.

For example, if a customer is about to buy a smartphone, there’s a much higher chance they’ll be willing to also buy a pair of headphones or a phone case to go with it if provided a good deal on these items. In fact, Amazon estimates up to 35% of its revenue comes from these types of cross selling practices.

Build an Omnichannel Customer View

Your customers engage with different touchpoints throughout their journeys and likely take multiple journeys concurrently. If marketers want to make cross-sell and upsell offers that will have a high win-rate, even as customers hop across channels and devices, they must have a complete, single customer view across all their touchpoints.

In addition to simply integrating data across touchpoints and internal systems, customer journey analytics solutions use identity matching to determine which events in each system are actually being performed by the same individual.

Cross-sell and upsell can be improved by incorporating data like:

- Which products or services are being used

- If and how their usage behavior has changed

- Whether their subscription is up for renewal

- Whether they have called the contact center or been on a support journey

- And much more

Having this data at every step along the customer journey will increase the chances of a cross-sell/upsell campaign manifold.

Three Examples of Cross Selling and Upselling

Upselling and cross selling are used in all different types of businesses and industries. Here are three examples of eCommerce sites which have applied these sales strategies:

Sleep Outfitters Cross Sells Bed Base with Mattress

Sleep Outfitters is a leading mattress retailer. When a customer purchases a mattress, the website immediately displays a cross sell by offering a bed base or foundation during the process of adding to cart. Since they know what size bed the customer is shopping for, they can even recommend the correct size.

Graham and Green Cross Sells Home Accessories with Furniture

Graham and Green is a British home lifestyle merchandiser. When a customer purchases large furniture items from them and begins check out, the website shows a cross sell and suggests small interior accessories such as candles or lamps which complement the larger furniture the customer is purchasing.

Upsells Warranties and Protections Plans with Computers

HP is a leading international PC manufacturer. When a customer begins purchasing a computer with them, the website shows upsells through various warranty and protection plans. They even include visual indicators to nudge customers toward the more comprehensive plans.

Bank Case Study: Next Best Product Recommendation Model

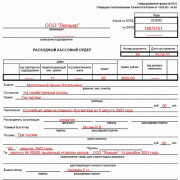

1. Objective: The objective for the Bank is to improve the efficiency of “Investment to Credit Card” cross-sell program based on focused targeting. Investment is also called a liability product in the banking industry.

Till date, the monthly cross-sell campaign file is based on a random pull of 100,000 customers from an eligible base of 200,000 credit card customers. The historical campaign response rates has been around 2%, that is, 2% of those contacted have expressed interest in the Investment cross-sell offer.

Structured campaigns have been conducted for this type of program and therefore campaign level data is available

An analytical approach to enable focused targeting is based on Segmentation and a Response Model

This Response Model will be used to identify customers most likely to take Investment products based on their past transactions and demographic behaviour.

The Response Model will be used to determine the target population to be cross-sold the product as well as the contact strategy. In this case, “what product” is an Investment product.

Special Considerations

Advisors who cross-sell financial products or services need to be thoroughly familiar with the products that they are selling. A stockbroker who primarily sells mutual funds will need substantial additional training if they are assigned to start selling mortgages to clients.

A simple referral to another department that actually sells and processes the mortgage may lead to situations where referrals are made whether they are needed or not, as the broker may not understand when the client really needs this service but is only motivated to earn a referral fee.

Advisors need to know how and when the additional product or service fits into their client’s financial picture so that they can make a more effective referral and stay compliant with suitability standards. FINRA may use the information that it collects from its inquiry to develop and implement a new set of rules that govern how cross-selling can be done.

Что такое кросс-продажи

Мы уже выяснили, что кросс-продажи – это продажа нескольких категорий товаров или услуг одному клиенту.

Главная задача этого инструмента маркетинга – убедить клиента купить товар одной или нескольких категорий, дополняющий его главную покупку. Для клиента это экономия на поиске дополнительной продукции, для продавца – дополнительная прибыль.

Пример 1. Предположим, вы пришли в магазин электроники и решили купить новый планшет. Вам сразу же предложат приобрести наушники, чехол, защитную пленку, стилус и.т.д. Эти товары принадлежат к разным категориям, но у клиента есть возможность купить все. К тому же со скидкой (чаще всего продажу дополнительных продуктов производят на более выгодных для клиента условиях). Часто такие предложения приносят около половины от прибыли компании.

Вот такой бытовой и упрощенный пример, для наглядности.

Пример 2. Банк реализует деятельность с помощью кросс-продаж с целью увеличения объема продаж, прибыли и лояльности клиентов. Кросс-продажи можно разделить на внешние и внутренние. Если банк работает по первому пути, то он к своей услуге предлагает услугу страхования, которую осуществляет компания-партнер. Если по второму – банк предлагает клиенту дополнительные товары или услуги внутреннего происхождения. К примеру, в дополнение к банковской карте предложат дистанционное банковское обслуживание.

Существует три варианта кросс-продаж:

- Продажа товаров той же категории одному покупателю. Пример: представьте, что покупаете в магазине спортивных товаров носки. Вас убедили, что носки нужны не только вам, но еще и бабушке, дедушке, свату, брату, сестре и коту. В результате вы покупаете не одну пару, а шесть, но с дополнительной скидкой.

- Продажа дополнительного товара или услуги. Продажа самостоятельной единицы продукции, не связанной с главной покупкой. Пример: у вас есть постоянный покупатель, который регулярно приобретает молоко и творог.. Вы открываете производство шоколада. И при совершении клиентом очередной покупки менеджер предлагает купить шоколадку того же производства. Вероятно, клиент согласится. И вернется снова.

- Пакетные продажи. Пример: вы покупаете стиральную машину, менеджер предлагает средство для чистки или резиновые подставки под ножки для нее. Категории товаров разные, но связаны с первой покупкой.

How Cross-Selling Works

Cross-selling to existing clients is one of the primary methods of generating new revenue for many businesses, including financial advisors. This is perhaps one of the easiest ways to grow their business, as they have already established a relationship with the client and are familiar with their needs and objectives.

However, advisors need to be careful when they use this strategy—a money manager who cross-sells a mutual fund that invests in a different sector can be a good way for the client to diversify their portfolio. But an advisor who tries to sell a client a mortgage or other product that is outside the advisor’s scope of knowledge can lead to problems in many cases.

If done efficiently, cross-selling can translate into significant profits for stockbrokers, insurance agents, and financial planners. Licensed income tax preparers can offer insurance and investment products to their tax clients, and this is among the easiest of all sales to make. Effective cross-selling is a good business practice and is a useful financial planning strategy, as well.

Not to be confused with cross-selling, upselling is the act of selling a more comprehensive or higher-end version of the current product.

Что такое up-sale, cross-sale и down-sale продажи

Выбрать подход нужно в зависимости от ситуации: категории продукта, его стоимости и других обстоятельств. Продажи up-sale буквально переводятся поднятие продажи. Смысл действий продавца заключаются в том, что клиенту предлагают купить более дорогой вариант продукта. Например, вместо базового набора тренингов предлагают vip-тариф, делая акцент на его преимуществах. Прежде всего, это персональное ведение во время обучения, участие в закрытых клубах и доступ к инсайдерской информации.

Третий вариант увеличения продажи – down-sale. Суть этого способа заключается в том, чтобы удержать покупателя. Покажем на примере издательского бизнеса, как это работает. Компания обратилась в издательство корпоративной прессы с задачей по подготовке ежемесячного корпоративного журнала. Когда менеджер предложил варианты, оказалось, что они не подходят по стоимости. В таком случае можно предложить им альтернативные варианты – дешевле: газета, информационный листок или сократить периодичность журнала на ежеквартальный.

Cross-selling challenges

Though effective cross-selling have always been the holy grail for banks seeking higher profits, getting sizable results is not an easy task. In particular, A.T. Kearney underlines low cross-selling indicators showing that customers on average have only 2-3 products from the same provider.

To increase these numbers, some banks tried to introduce incentives for banks’ sales teams. But as showed earlier this year, using an aggressive bonus-driven system of remuneration for selling additional products can result in failure and fall apart like a house of cards ruining a bank’s reputation and making customers switch to another bank. That is why, to cross-sell effectively, banks should scorn the wide-spread ‘sell-sell-sell’ mantra and focus on presenting additional products by means of a mobile banking app, among other relevant channels.